Another interesting day in markets today, we began the session near overnight lows and rallied strongly, with ES climbing 30 points off the 9am lows, then quickly reversing again to drop 45 handles in a straight line down move. Internals have been calling for all of the recent rallies to reverse, as noted in our Twitter and Stocktwits streams, and this was no exception.

Volatility was up sharply, and we have to note an interesting scenario, where spot VIX has backwardated (made a higher price than) both the front and near month VIX futures. This is a setup potentially for VIX to have a sharp move upwards, and for spot to pull up the futures in kind. See here for the VIX futures curve in relation to spot VIX.

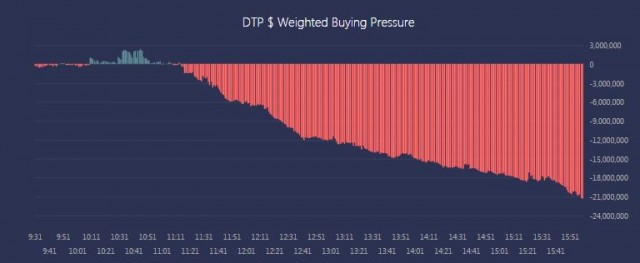

The $ Weighted Buying pressure chart has been extremely useful of late, because the recent rallies have occurred on such narrow breadth, this chart follows the dollar weighted volume of key market moving issues, thereby providing a rare window into what large money movers are doing in those key stocks. Today, they were selling in large volume as shown in the chart below.

Curiously, Overall breadth was slightly better than it has been in the last few sessions, which means that a retrace of part of today’s down move is likely. We do expect new lows to come, and as always, confirm with bearish market internals before placing any guesses on direction.