Futures in premarket shrugged off the down move of yesterday, particularly NQ100 futures which retraced within ticks of all time highs. The important news item of the day occurred in premarket session with rate announcements by Draghi of the ECB, announcing another rate cut in overnight repo rates and a minimum 6 month extension in ECB’s version of QE. The markets appeared dissapointed by the lack of further outright stimulus, that or were working off the overbought conditions of the recent rally. Either way, down we went, not long after open.

ES bottomed late in the RTH session 55 points off overnight highs, a big drop, with NQ futures a stunning 150 odd points off highs.

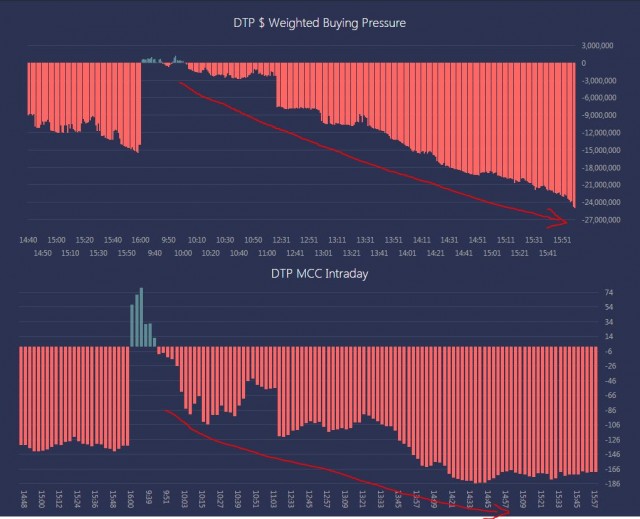

Dollar weighted buying pressure showed steady and increasing selling all day, as did the MCC.

Breadth started out neutral today, but slowly and surely fell lower throughout the session.

IN after hours action, as it typical, futures are clawing back some of their losses, but the reaction off big jobs data tomorrow in premarket should set the tone for the day. Expect to short rallies for the coming session, to be confirmed as always with bearish internals.