Futures dipped lower on open of the SUnday night session, with ES (S&P500 mini futures contract) dipping below the important 2000 level but only briefly, which struck major support, and the bottom was in for the evening session, never being retested.

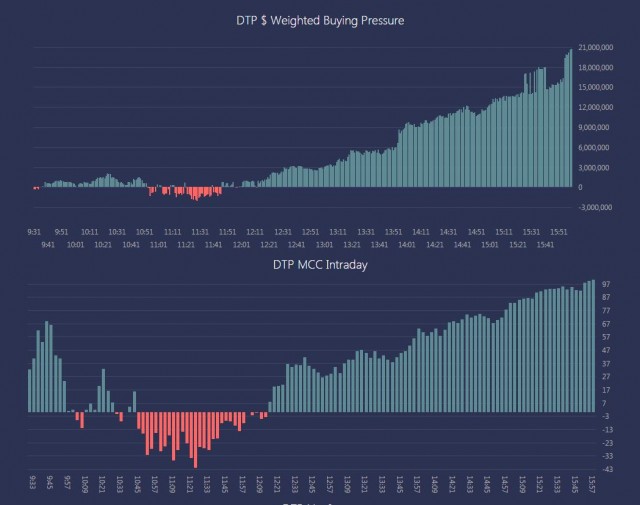

Opening action saw a lot of chop and sideways movement, directionless trade but a stealth rally developed as net issues and net volume of issues started gaining ground after lunch and continued building steam all afternoon, providing a solid >1.25% up day for most indexes by close.

Markets needed a correction after a huge rally back above the 2100 level from the August and September lows, but was last week and >100 SP points enough? The next few sessions will be key to seeing if this was a bear market rally or the beginning of a new bull segment to new all time highs. Stay tuned